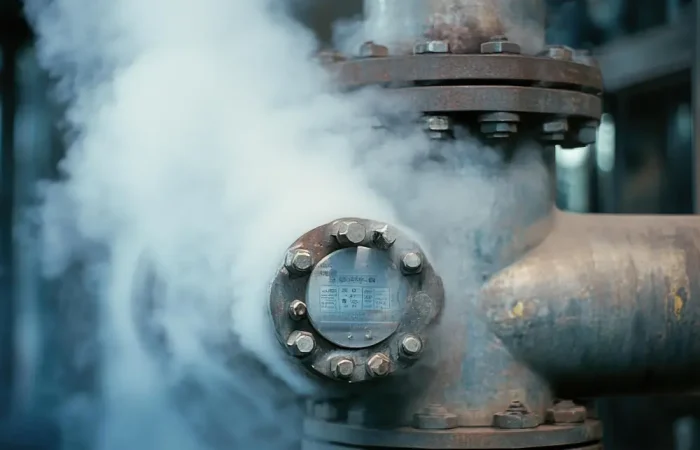

In the world of construction, infrastructure development, and industrial fabrication, timing can make or break a project’s budget. And as 2025 approaches its final month, contractors and procurement managers are once again evaluating the best moment to secure critical materials—especially Stainless Pipe, one of the most in-demand components across Philippine industries.

December has historically been a strategic month for buyers due to unique year-end global market behaviors, import schedules, and supply-price adjustments. With international suppliers aligning their inventory cycles and the Philippines preparing for peak construction months after the holidays, December 2025 presents a window of opportunity that project managers shouldn’t ignore.

In this guide, we break down the data, market forces, and procurement strategies that make December potentially the smart month to finalize your Stainless Pipe orders—backed by insights from reputable sources such as IndexBox, Metal Exponents, Regan Industrial, 6Wresearch, Fastmarkets, and Outokumpu.

Recent Price Movements for Imported Stainless Pipes — What the Data Shows

Recent reports from IndexBox and Metal Exponents highlight price movements in several Asian stainless-steel markets that directly affect imports to the Philippines. Based on these analyses:

1. Stainless Pipe Prices Have Seen Notable Oscillation in 2024–2025

IndexBox reports moderate upward pressure driven by nickel volatility and fluctuating production output in China and Indonesia—two major supply sources for Philippine importers.

Metal Exponents also indicates that stainless steel prices across Asia are experiencing:

- Short-term dips during year-end slowdowns

- Early Q1 rebounds as industrial activity accelerates

This pattern means December often presents more stable buying conditions before Q1 price resets take effect.

2. Import Cycles Favor December Buying

Because global mills and exporters seek to close annual sales targets by December, many offer:

- Preferential pricing

- Bulk-order incentives

- Faster shipment scheduling ahead of Chinese New Year closures

For Philippine contractors whose projects restart strongly in Q1, locking in Stainless Pipe supply by December ensures continuity and prevents expensive January–March purchases.

Economic & Industry Drivers — Construction, Energy, Infrastructure Demand Rising

Demand for Stainless Pipe in the Philippines has been consistently rising, supported by several key sectors.

1. Construction Boom & Industrial Expansion

Regan Industrial describes stainless materials as “core building components” in modern infrastructure—from high-rise plumbing systems to commercial fit-outs.

Multiple market studies, including 6Wresearch, note that:

- The Philippines maintains strong momentum in commercial construction

- Government-backed infrastructure programs continue to push national demand

- Industrial zones, energy facilities, and manufacturing plants require stable stainless-steel supply

2. Stainless Pipe Consumption Expected to Grow in 2025

With the government’s Build Better More (BBM) infrastructure agenda, analysts expect:

- Higher material demand

- Pressure on local distributors’ inventory

- Increasing reliance on imported stainless pipes to fill the gap

This means competition for supply will intensify—especially by Q1 2026.

Risks of Waiting — Price Hikes & Supply Disruptions Could Hit in 2026

Several global risks make delaying procurement a gamble.

1. Raw Material Inflation Due to Nickel Market Volatility

According to Fastmarkets, nickel—a major component of stainless steel—remains highly volatile due to:

- Indonesian export policy shifts

- Changing ESG compliance in global mining

- Demand from electric-vehicle battery production

Even small price spikes in nickel can significantly raise Stainless Pipe prices.

2. Global Supply Chain Instability

Outokumpu and Fastmarkets both warn of ongoing structural risks:

- Shipping delays

- Port congestion

- Container shortages

- Fuel cost increases

These disruptions tend to peak after New Year holidays and can extend into Q2.

3. Seasonal Mill Closures & Production Slowdowns

Many Asian stainless mills slow production during:

- Lunar New Year

- March maintenance periods

This reduces supply and drives up prices, meaning orders placed too late may face:

- Longer lead times

- Higher premiums

- Limited size/grade availability

How to Plan Stainless Pipe Procurement Strategically

To maximize savings and ensure uninterrupted project flow, contractors and procurement officers should take the following steps:

1. Review Your 2026 Project Timeline Early

Map out required Stainless Pipe quantities for:

- Plumbing systems

- Structural tubes

- Industrial piping systems

- Railings, fabrication, and other metalwork

2. Forecast Steel Needs for the Entire First Half of 2026

This prevents mid-project price shocks and avoids emergency purchases during peak season.

3. Coordinate With Reliable Local Suppliers

Partner only with distributors that:

- Maintain consistent inventories

- Offer competitive import pricing

- Provide mill test certificates (MTC)

- Deliver predictable lead times

A trusted supplier like Megalos Ferro Inc. helps mitigate risk through strong supply relationships and stable procurement channels.

4. Budget for Price Volatility

Allocate a contingency fund of 8–12% for material cost fluctuations—standard practice for large-scale construction in the Philippines.

5. Consider Lock-In Contracts for Q1–Q2 2026 Needs

Many major contractors secure 3–6 months’ worth of materials in December to avoid:

- January price corrections

- Lunar New Year supply delays

Should You Lock In Your Stainless Pipe Orders This December?

Based on market data, industry forecasts, and historical pricing patterns, December 2025 presents a strategic advantage for buying Stainless Pipe in the Philippines. With relatively calmer price conditions, year-end supplier incentives, and the looming risks of 2026 supply-chain tightening, contractors who lock in early can:

- Protect their project budgets

- Ensure material availability

- Avoid Q1–Q2 price surges

- Maintain project timelines

For builders, fabricators, engineers, and procurement teams, the question is not “Can I wait?” but “What will waiting cost?”

If your project requires stainless steel in early 2026, December may truly be your best window to secure supply—before global and local markets shift once again.

Optimize Procurement With a Reliable Partner: Megalos Ferro Inc.

Megalos Ferro Inc. is one of the Philippines’ trusted providers of Stainless Pipe, supplying contractors, builders, and industrial companies with high-quality materials and consistent availability.

Whether you need bulk orders, custom sizes, or fast delivery across Luzon, Visayas, and Mindanao, our team provides reliable, compliant, and cost-efficient stainless-pipe solutions.

📞 Contact us today to secure your December 2025 pricing and ensure uninterrupted supply for your 2026 projects.